MoneyPatrol

Accurate Money Management and Personal Accounting

About MoneyPatrol

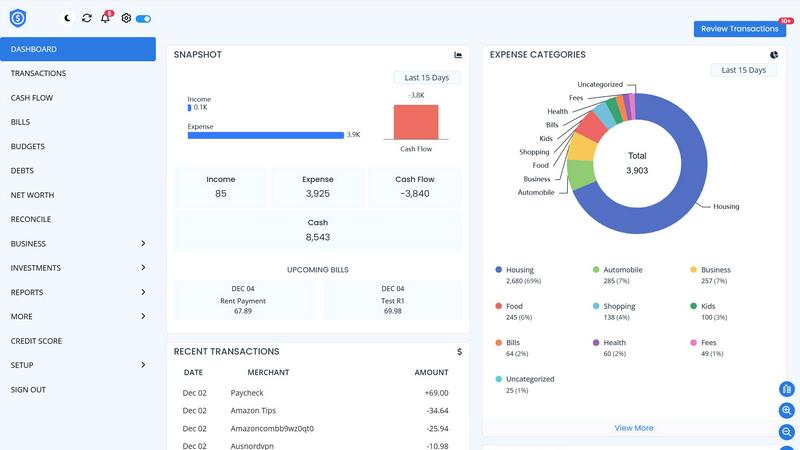

MoneyPatrol is an all-in-one free personal finance tool that elevates beyond simple budgeting apps by offering deeper insight, better connectivity, and full personal accounting capabilities. It is designed to help users track, monitor, and manage all their finances in one place. It brings together expense tracking, budgeting, bill reminders, investment & net-worth tracking, alerts and more.

Some of the major capabilities of MoneyPatrol are:

-

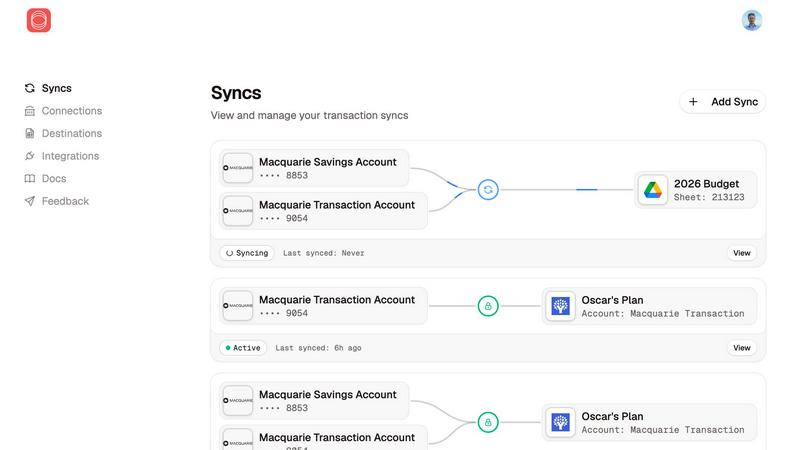

Account aggregation: You can link bank accounts, credit cards, loans, investments, etc., all into one dashboard.

-

Income & Expense tracking: It shows money flowing in and out, categorizes transactions (by merchant/category), shows trends over time (day, week, month, quarter).

-

Budgets: Create budgets for different spending categories, monitor how you’re doing, create monthly and annual budgets for categories and subcategories.

-

Bill tracking & alerts: Get reminders about recurring bills, due dates, and warnings about overdraft, duplicate or fraudulent transactions.

-

Net worth & debt tracking: View your overall financial position: what you own vs. what you owe, track debt pay-down, investment growth.

-

Credit Score tracking: Track your weekly and monthly Credit Score. See your outstanding debts and credit card usage and work on improving your credit score.

Top Alternatives to MoneyPatrol

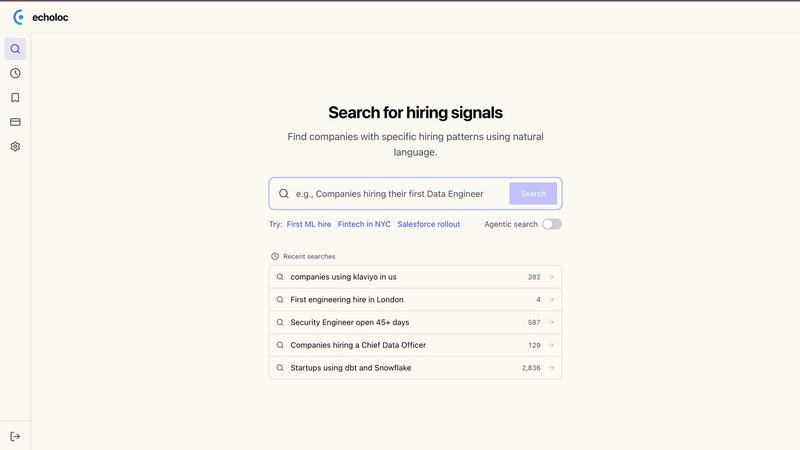

echoloc

Discover buyer intent through real-time job postings before they signal a need.

Fieldtics

Streamline your service business with easy scheduling, invoicing, and customer management.

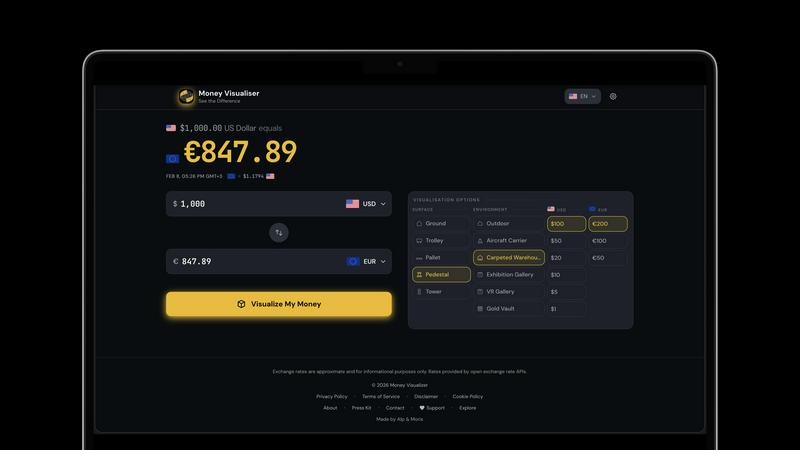

Money Visualiser

Transform any amount of money into interactive 3D bill stacks to visualize and compare real cash dimensions.

Tailride

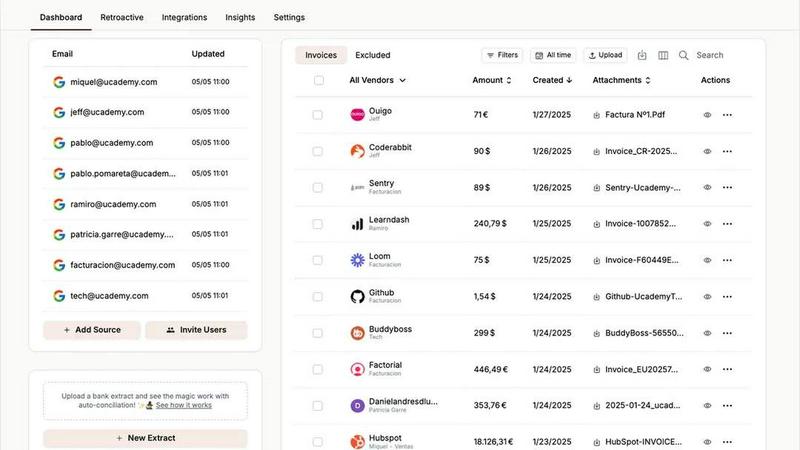

Tailride automates your invoice chaos by scanning emails and portals with AI.